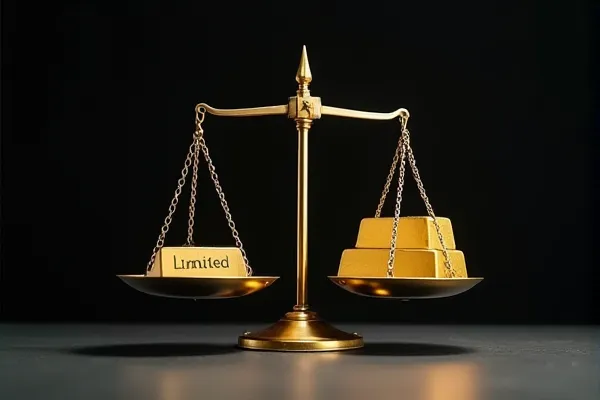

In California, the “Unlimited” designation is critical for serious injury cases. Under Code of Civil Procedure § 85, “Limited Civil” cases are capped at $35,000 (formerly $25,000) and have restricted discovery rights—meaning you cannot take as many depositions or ask as many questions. Insurance companies love to force cases into Limited Jurisdiction to trap you with these caps. We aggressively file cases as Unlimited Civil Actions. This ensures there is no ceiling on your recovery and gives us the full power of discovery to uncover the defendant’s negligence.

Civil Lawyer: The $35,000 Jurisdiction Threshold — how to keep California procedure from capping your case

In San Diego, the $35,000 line is where “limited” and “unlimited” civil cases split under California Law. The single most important rule: do not let an insurer steer you into a case posture that restricts tools and leverage before your damages are fully documented.

What I’ve seen happen when people misunderstand the $35,000 line

Once your case is in San Diego Superior Court, the defense evaluates you through procedure as much as through medicine. Under California Law, the $35,000 threshold is tied to case classification, and classification changes what you can force the insurer to do.

Here’s a realistic San Diego scenario: a rear-end collision on I-805 near University Avenue, cervical and shoulder injuries, and a carrier that “reserves” while you treat. Early bills look like they’ll fit under $35,000, so the defense pushes a quick resolution and hints you should keep it limited. We do the opposite of guesswork: we map out damages, prove causation, and choose the case posture that preserves leverage while we build the file. When the defense realizes you understand the threshold, the tone changes.

The $35,000 threshold is not a moral judgment about your injury. It’s a procedural gate that affects discovery scope, trial preparation pressure, and how seriously the carrier budgets risk.

If you’re in the gray zone, the defense will try to freeze your case posture early, then argue later that you don’t have enough evidence to justify more. That’s an insurer-side move, and it’s predictable.

Why the $35,000 threshold materially changes leverage in San Diego

CCP § 86 defines a limited civil case using an amount-in-controversy ceiling, and that classification affects the litigation “gear” you can use. Limited cases often move on tighter tracks, and the defense prices them differently.

And even when a plaintiff files as unlimited, the court can look at whether the case could have been brought as limited when deciding cost consequences under CCP § 1033. That’s why this line isn’t trivia; it’s a litigation risk factor.

The “Immediate 5” questions San Diego injury victims ask about the $35,000 threshold

1) What exactly does “$35,000 jurisdiction threshold” mean in a San Diego civil injury case?

It’s a classification threshold tied to whether your case is “limited” under CCP § 86, which uses the amount in controversy as a defining feature. The practical effect is that your procedural track can change, and insurers adjust tactics when they believe the case is boxed into limited leverage.

2) If my damages might end up over $35,000, how do we avoid locking the case into the wrong posture?

We do not guess early. We document medical necessity, wage impact, and future care exposure before we let the defense force a “small case” narrative. If the case posture needs to change, California procedure provides pathways to address classification issues, including considerations under CCP § 88.

3) How does the threshold change discovery and the insurer’s willingness to take risk?

Limited cases typically operate under a more constrained discovery framework, and the defense expects fewer pressure points. That framework is reflected in statutes such as CCP § 92. When discovery is narrower, insurers often lowball longer because they believe you can’t force the same level of proof and accountability.

4) Why do I keep hearing that I “can’t put a dollar amount” in the complaint for a personal injury case?

California pleading rules restrict stating a specific amount of damages in many personal injury complaints under CCP § 425.10. Instead, a separate statement of damages procedure exists under CCP § 425.11, and that reality is one reason insurers try to control the narrative early.

5) If we file as unlimited and the jury comes back under $35,000, what can that change after the fact?

It can affect cost consequences and how the court views the reasonableness of choosing an unlimited track, especially through the lens of CCP § 1033. The defense knows this and uses it as settlement pressure: they try to make you fear being “punished” later so you accept less now.

In San Diego, the insurer’s favorite move around the $35,000 line is to treat your case like a spreadsheet: keep it limited, keep it quiet, keep the offer low. They’ll talk “efficiency” while they slowly starve the claim.

If you’re close to the line, your job is not to be “reasonable.” Your job is to be provable and procedurally correct, so the carrier can’t buy discounts with confusion.

Magnitude expansion: what actually moves value when the case sits near $35,000

A) Evidence Evaluation in San Diego Cases

The defense doesn’t need your case to be weak; they only need it to be messy. Near the threshold, clean proof is the difference between “limited money” and real evaluation.

- Police reports vs medical records: consistent timelines prevent “unrelated treatment” narratives.

- Scene photos vs repair documentation: counters “low-impact” minimizing tactics.

- Treatment timeline consistency: unexplained gaps become leverage against causation and necessity.

- San Diego claims handling reality: carriers delay to see if you’ll cap yourself under the threshold.

B) Settlement vs Litigation Reality

Once filed in San Diego Superior Court, the defense shifts from claims adjusting to litigation risk management. If the case posture preserves tools and deadlines, the insurer starts budgeting defense spend and exposure instead of hoping you’ll accept a nuisance number.

If the posture is constrained, the insurer often rides the file longer, betting you can’t generate the pressure needed to force a real evaluation.

C) San Diego-Specific Claim Wrinkles

San Diego traffic patterns create repeatable liability fights that insurers use to keep damages “uncertain” and value “low,” especially in rear-end chains and freeway merges. When liability is disputed, the insurer leans harder on the $35,000 line because they believe you’ll trade upside for speed.

- Traffic density and rear-end patterns: “everyone brakes hard” is used to dilute fault.

- Multi-vehicle freeway collisions: insurers spread blame to shrink any single payout.

- Common SoCal resistance patterns: early “limited case” framing followed by late-stage low offers.

Lived Experiences

Victor

“The insurer kept telling me ‘it’s a limited case’ like it was already decided. Richard explained how the $35,000 line actually works and built the proof so they couldn’t keep minimizing my injuries.”

Caroline

“I thought filing was just paperwork. Richard treated procedure like leverage and made sure we didn’t get boxed into the wrong track. The defense stopped playing games once they realized we weren’t guessing.”

California Statutory Framework & Legal Authority

Attorney Advertising, Legal Disclosure & Authorship

ATTORNEY ADVERTISING.

This content is provided for general informational and educational purposes only and does not constitute legal advice.

Under the California Rules of Professional Conduct and applicable State Bar of California advertising regulations,

this material may be considered attorney advertising.

Viewing or reading this content does not create an attorney-client relationship.

Laws and procedures governing personal injury claims vary by jurisdiction and may change over time.

You should consult a qualified California personal injury attorney regarding your specific situation before taking any legal action.

Responsible Attorney:

Richard Morse, California Attorney (Bar No. 289241).

Morse Injury Law is a practice name and location used by Richard Peter Morse III, a California-licensed attorney.

About the Author & Legal Review Process

This article was prepared by the legal editorial team supporting Richard Peter Morse III,

with the goal of explaining California personal injury law and claims procedures in clear, accurate, and practical terms for injured individuals in San Diego and surrounding communities.

Legal Review:

This content was reviewed and approved by Richard Morse, a California-licensed attorney (Bar No. 289241),

who concentrates his practice on personal injury litigation and insurance claim disputes.

With more than 13 years of experience representing injury victims throughout California,

Mr. Morse focuses on serious personal injury matters including motor vehicle collisions, uninsured and underinsured motorist claims,

premises liability, catastrophic injury, and wrongful death.

His practice emphasizes claims evaluation, insurance carrier accountability, and litigation in California courts when fair resolution cannot be achieved. |